Payroll API

The Payroll API delivers a comprehensive solution for payroll data analysis, including salaries and benefits of business employees. Regardless of the data storage method, whether it is through a payroll software or manual entry into hardcopy documents, our API handles the intricacies seamlessly.

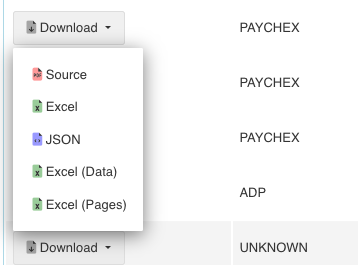

A common obstacle with payroll data is just that, information is often presented in PDF form or as scanned images comprising of hundreds of pages. The Payroll API is able to parse through these files, extract and normalize the data, and then present it in either Excel or JSON format for download. Moreover, the API also provides information on the completion status of the data extraction as well as a quality rating for each document. The resulting data is presented in a refined and user-friendly manner, allowing full use of the data.

For more information on available payroll integrations, examples, and information, you may visit our complementing Payroll API webpage.

Data Provider Support

While API is the preferred access method many payroll software providers do not yet feature the necessary API access, to alleviate this and support the long tail of payroll providers we support report based access.

API access enables a continuous connection while report based access helps facilitate point in time access - both methods support as much historical data as is available.

API Access

With API access the employer grants permission by signing in to their payroll software and agreeing to provide access to their payroll data, the payroll provider delivers an API token which may then be used for an initial read of data as well as ongoing access. With this method we do not store any user name or password information, if the user changes their password the access is not revoked. Boss Insights manages the connection and ensures the API access is continuously available until specifically revoked either by the employer or by the financial institution.

Report Based Access

With report based access the employer has two options for sharing data:

Upload a detailed payment report file manually that they have previously downloaded

A guided experience using a browser extension

Regardless of which method is used to gather the source report the data will be automatically extracted and verified without any human intervention. As part of the verification process we can validate time periods provides as well as level of detail required.

The guided experience using a browser extension directs the employer to login to their payroll provider and then automatically navigates them to the correct payroll report generation page and prompts them with guidance to send the generated report back for processing - all within the payroll providers user interface that they already know and without us needing to know the username or password - providing a secure and trusted experience.

Getting Access

There are two ways of getting access to payroll data via Boss Insights:

Employer permissioned access via API or Report Based Access

Document conversion

Employer permissioned access

To get Payroll data an employer provides permissioned access either via API or report based access. Depending upon the level of access granted data can be obtained once or it can be continuously shared until explicitly disconnected.

Employer permissioned access to Payroll data provides read/write access to the payroll platforms we support.

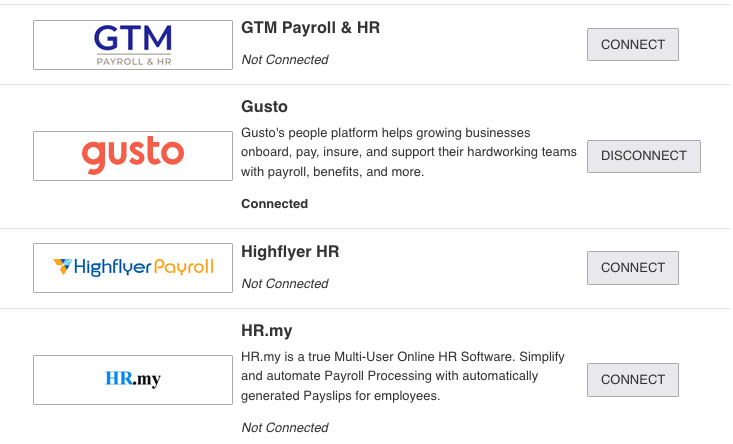

The employer connects their payroll from a wide variety of supported providers

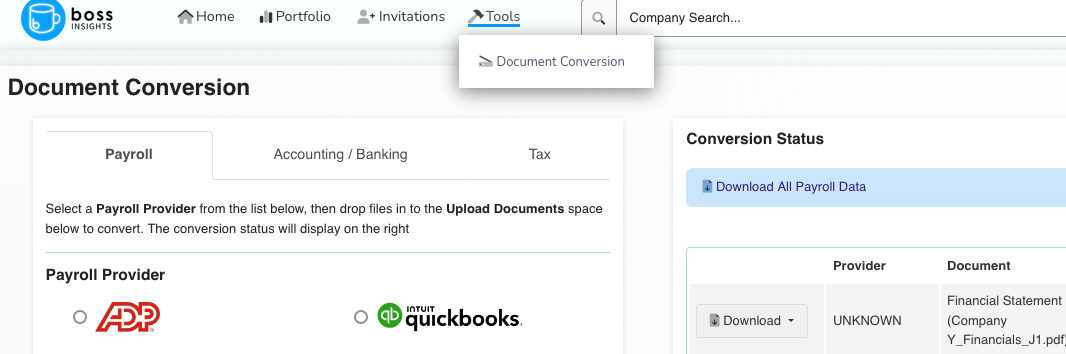

Document conversion tool

Are you tired of sifting through endless PDFs to track employee salaries and benefits? Look no further than our payroll data document conversion tool! With just a few clicks, you'll have access to detailed information on salaries, taxes, and other benefits in Excel or JSON format. Say goodbye to the headache of manual payroll management and hello to streamlined data access. With our tool, you'll get a better sense of the financial health of an organisation and its employees. Not only will this help you make more informed decisions, but it can also save time and money.

A standalone document conversion tool is provided for ad hoc payroll document conversion

Document conversion API

Our API provides a document conversion endpoint which will take as input a payroll PDF and return after processing the cleaned and standardized data. The data can be returned in either Excel or JSON format. For more information on this approach see Document Conversion.

Data output

The payroll data can be output as either Excel or JSON format. Fields available for each employee and for each pay period include:

Field | Description |

|---|---|

Platform | Which payroll software is providing the data, e.g. Gusto or ADP |

Business/DBA | The name of the employer |

Coverage Start | The start date of the pay period |

Coverage End | The end date of the pay period |

Employee Number | Any employee number or identifier |

Employee Name | The full name of the employee |

Pay Frequency | How often the employee is paid, e.g. Monthly, bi-weekly |

Hourly Rate | The regular hourly rate |

Salary | The annualized salary |

Check Date | The date the salary payment was disbursed to the employee |

Cheque Number | An identifier or reference for the salary payment |

Gross Wages | The pre-tax wages earned |

Social Security | Social security deductions |

Medicare | Medicare deductions |

Federal Tax | Any federal taxes |

State Tax | Any state taxes |

Local Tax | Any local taxes |

Regular Hours | The number of hours the employee worked for in the pay period |

In addition:

Overtime hours & wages, Holiday & sick hours

Deductions such as Dental, Health, HSA and other pre/post tax deductions

Commissions, Bonuses and Reimbursements

Company contributions to social security, medicare and more.

We do not provide full unmasked access to employee SSN, SIN or other tax identifiers

Source Documents

In addition to the cleaned and standardized data the raw source data is made available via our user interface and our API. In the case of source API access the raw data in JSON format can be obtained while the PDF document is available in the case of report based access.

Source documents are available with the UI or API