PPP Loan Origination

The Boss CARES platform supports automating the process of loan origination for first and second draw PPP loans as well as forgiveness. The platform provides an application request form as well as a fully automated application process that connects to the SBA’s modern ETRAN based API to obtain PPP loan approval.

Process Overview

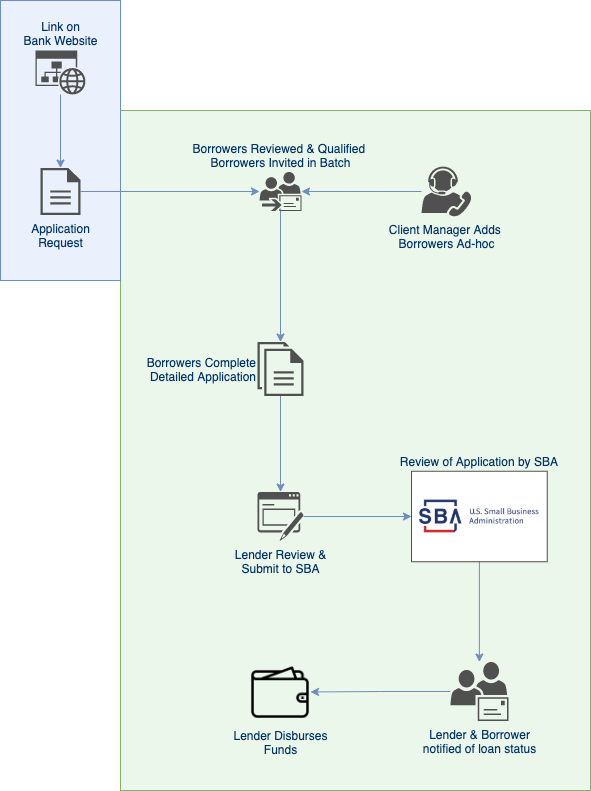

The process of inviting a client to complete a PPP loan application will differ slightly depending on whether you are adding a client to the platform one at a time as might happen when borrowers call or email you directly versus when they apply via an application request form linked from your website.

Application Request Form (optional)

You may optionally decide to prescreen applicants using an “Application Request Form” to ensure that only qualified businesses enter your PPP loan pipeline, this is shown in blue in the diagram below. Applicants fill out a quick subset of the application and get immediate feedback on whether they may qualify or not. Any information entered in this stage gets carried over to the later application stage shown in green so borrowers do not need to re-enter information. This application request form is suitable for linking to from your website or including in any email campaigns to your existing clients. These prescreened borrowers are then invited via email to complete the application process.

You may choose to send the application request form to only existing customers or open it up to new customers. Additional KYC checks and loan officer assignments may be required.

Inviting Borrowers

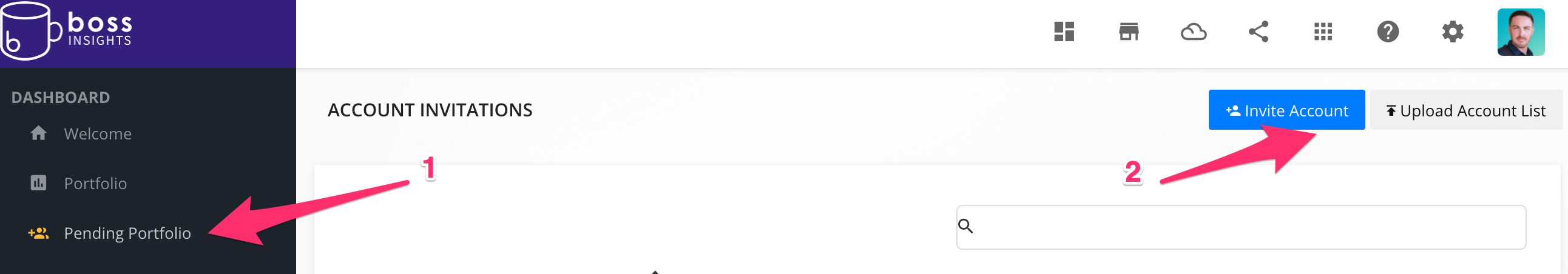

Inviting borrowers to complete a loan application can either be done in batch (via CSV upload) or one at a time ad-hoc. Choose “pending portfolio” from the side navigation menu, then choose either “Invite Account” or “Upload Account List” depending on whether you want to invite one or many borrowers to complete an application

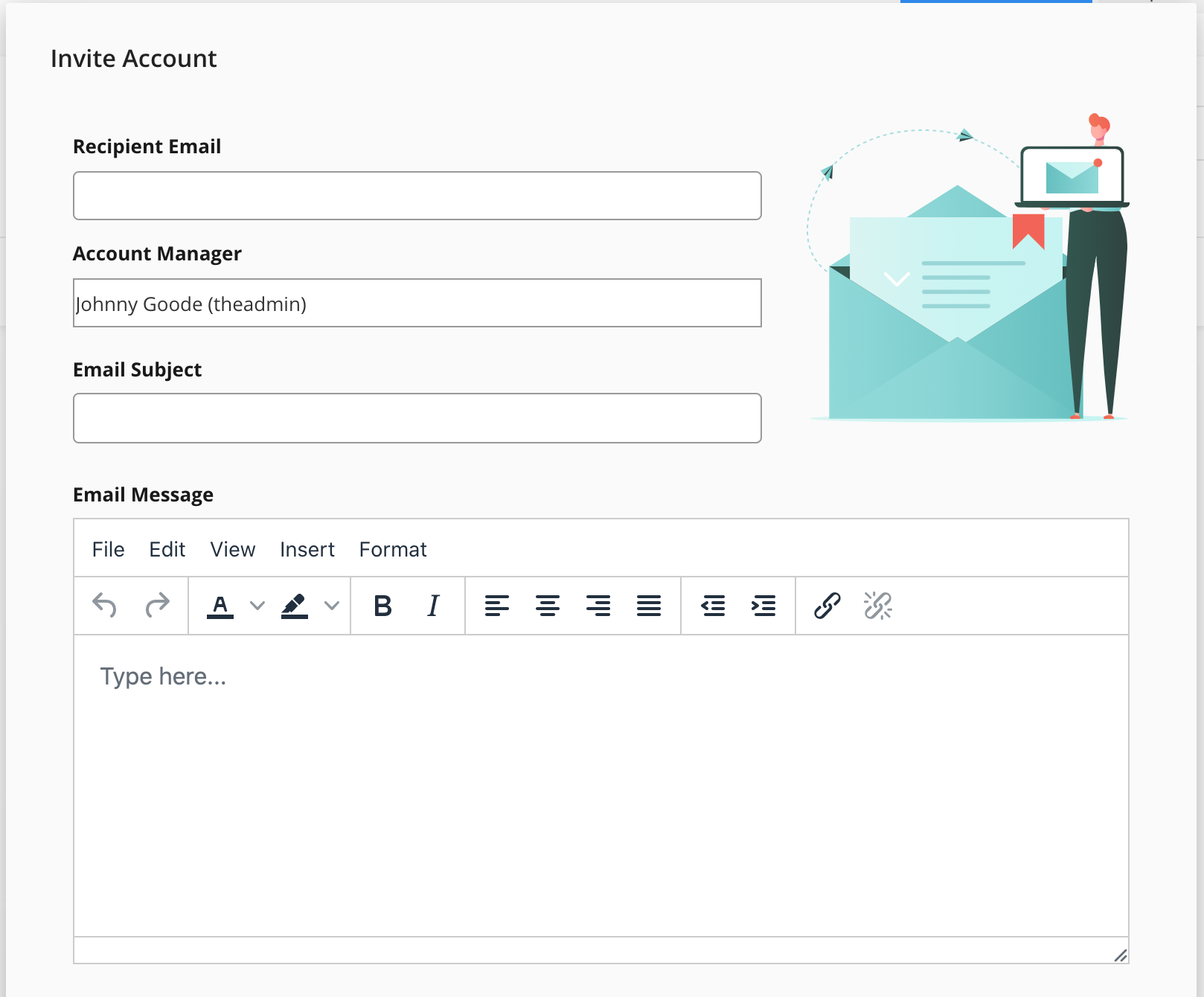

When inviting one borrower at a time you will have the opportunity to tailor the invitation message sent to them as well as select the “Account Manager” aka loan officer that will be assigned to this borrower.

If you choose to import in batch you will need to supply a specially formatted CSV file which contains fields which match the loan application if you want information to be pre-filled for the borrower where possible. After clicking “Upload Account List” a dialog will appear that gives the option to download a template CSV file to use for this purpose.

Upon sending the invite to the borrower they will receive a branded email which contains a link allowing them to securely sign in to the platform.

Borrower Sign In

Once a borrower has been invited via email they will proceed to create a secure login on the platform. This involves them entering their email address (for verification purposes) and choosing a password and subdomain to access the application later if needed.

Borrower Application

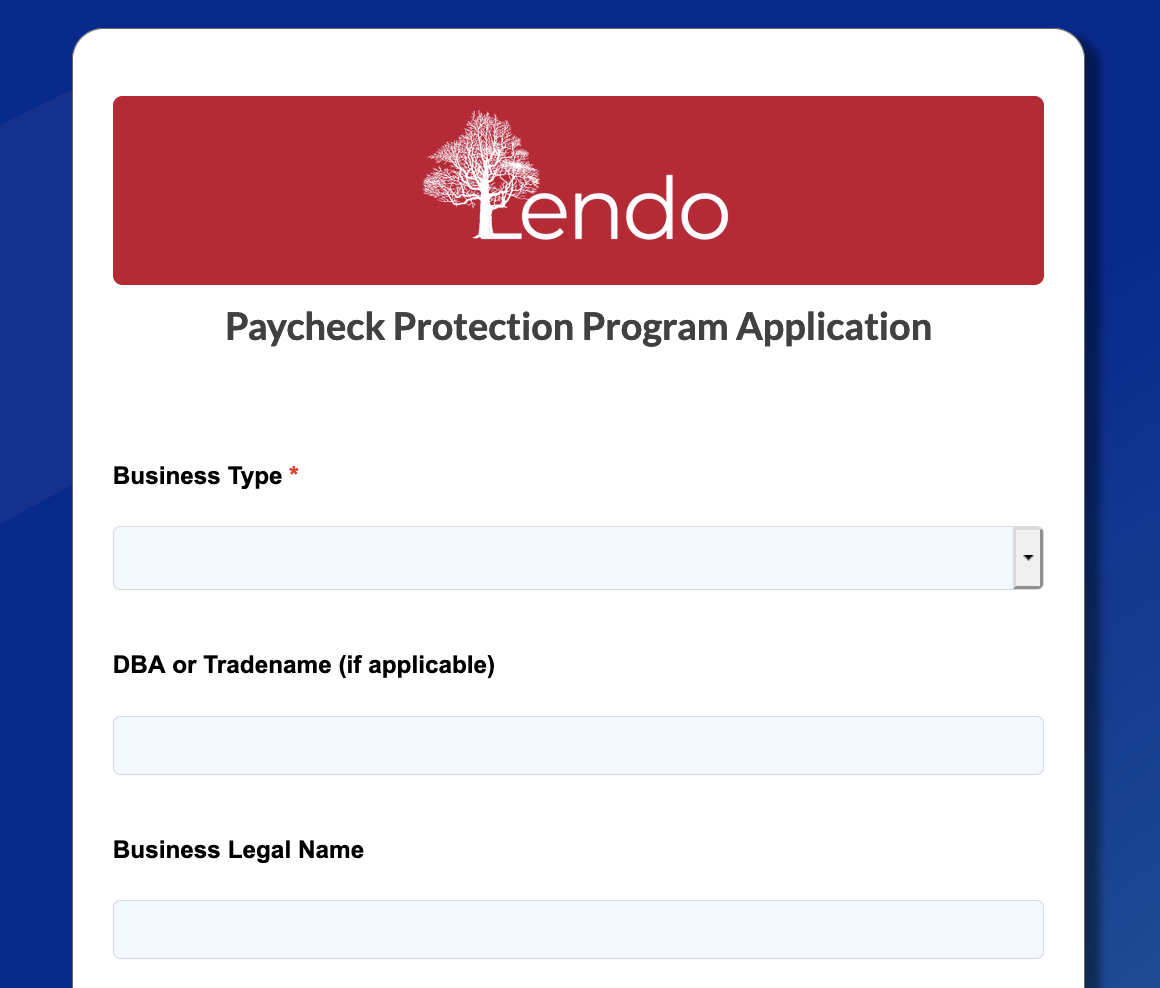

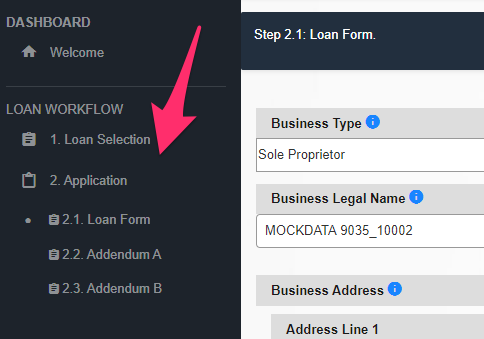

Initially the borrower will be greeted by your custom welcome message and can then proceed through the workflow menu on left side of the page. Initially they will choose a first or second draw loan and then proceed to fill in the appropriate form.

The applicant then follows the easy steps provided that guide them through the process of providing information, calculating eligibility, attesting and submitting the application for your review in a detailed application.

The applicant can choose to save their work partially completed and return to the platform to complete their application later if they choose or they can submit it immediately if they have all required information to hand.

The platform will run through a number of validations to ensure that information provided by the applicant is as accurate as possible and reduces the number of SBA rejections to a minimum, some of the dozens of checks include:

In second draw loans we validate the provided SBA Loan ID matches the first draw loan amount, the lender also will see the borrowers address and business name from the first draw loan

Once the application has been submitted the applicant will need to wait for the lender to review the application and continue the process to submit to the SBA.

The review of the loan application by the SBA is not instantaneous and can take between several hours and a day to complete.

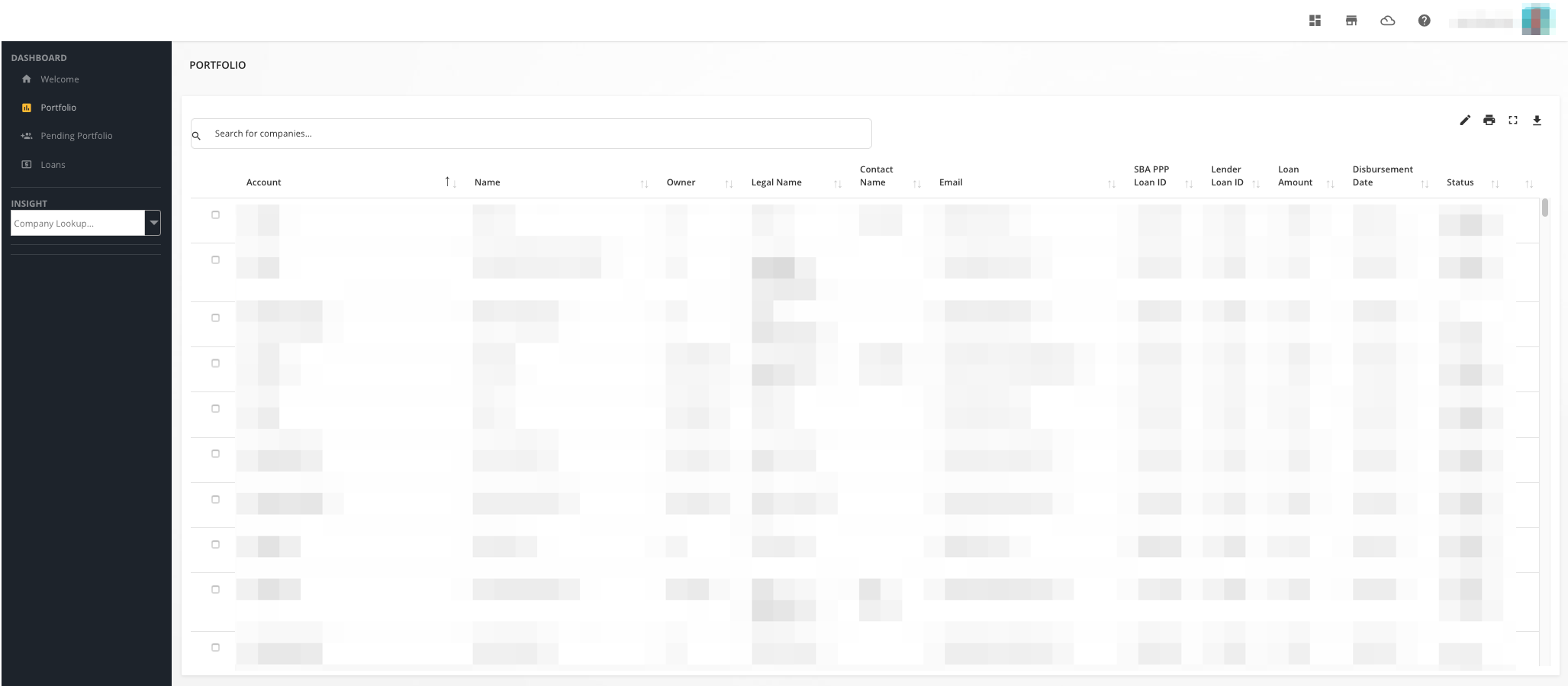

Lender Portfolio

From your lender portfolio management page you can see the status of all clients invited to the platform and quickly review each submitted application before sending to the SBA for review. This same portfolio page will also show the SBA approval status, allowing you to quickly sort and search for approved and declined applications.

A full list of the origination statuses shown in the portfolio is available on our origination FAQ

Reviewing Applications

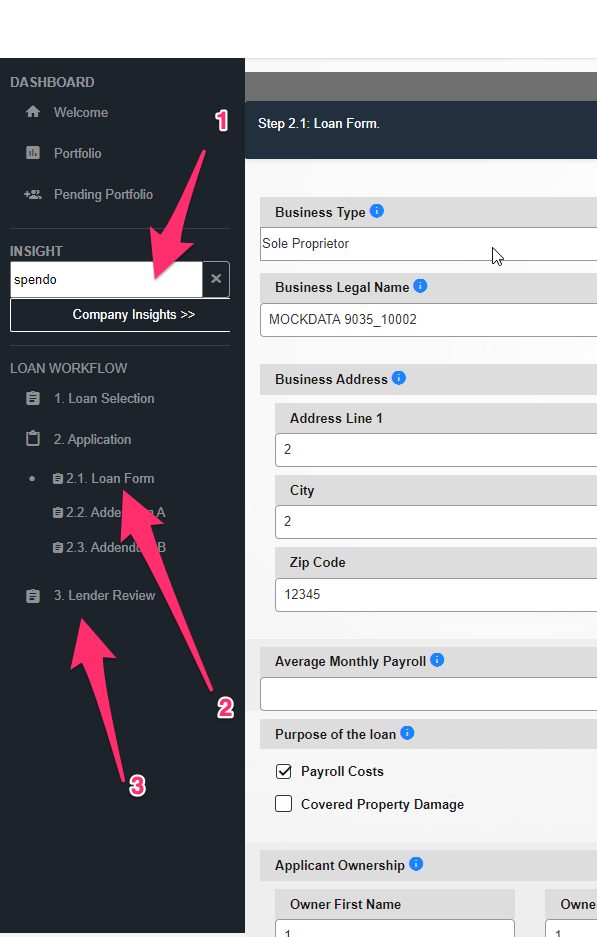

To check the current completion status of an applicant just enter their account name (shown on the portfolio page) in to the INSIGHT search box on the left side navigation. You will be presented with the same workflow steps the borrower sees plus any additional lender specific step.

Clicking on the various workflow steps will allow you to see the same data as entered by the loan applicant, this is useful in reviewing the loan before submission to the SBA.

The “Lender Review” workflow step is only visible to the lender and provides for lender attestation and submission to the SBA. Should an error be found either before or after SBA submission the lender review also allows the application to be rejected and sent back to the borrower for correction. If you need to have the borrower make corrections to the application you should contact them directly.

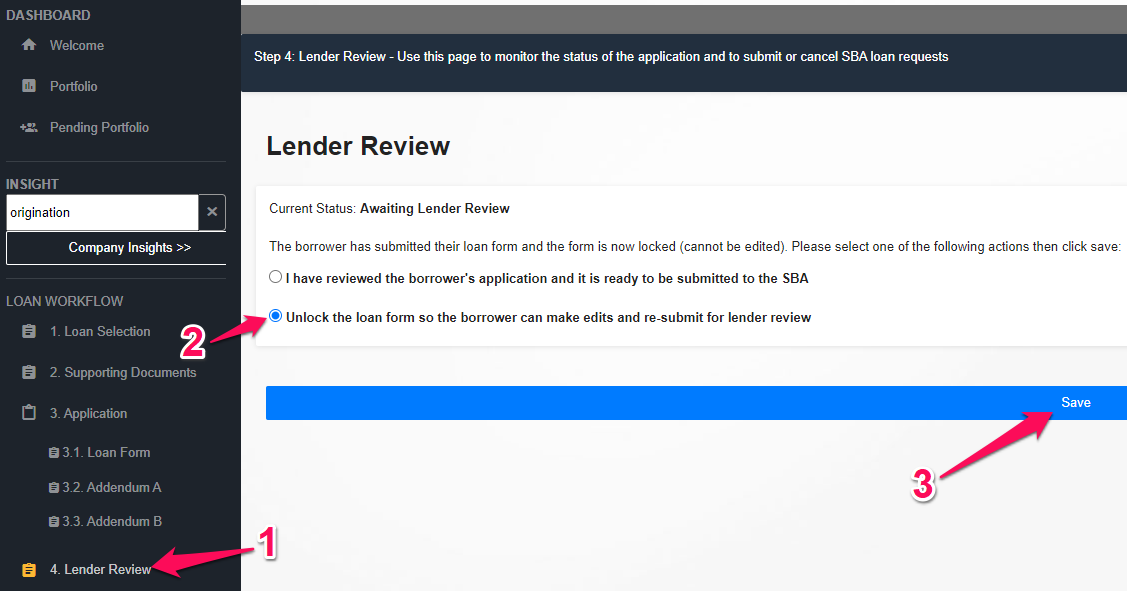

Returning Applications to Borrowers

Once a borrower has submitted their loan form, the application status is changed from “In Progress” to “Awaiting Lender Review”. At this point, the borrower can no longer make changes to their loan form, however they are still able to upload additional documents.

If further changes to the loan form are needed, the lender is able to return the application to the borrower from the Lender Review page. To do this, click “Lender Review” in the sidebar, select “Unlock the loan form so the borrower can make edits and re-submit for lender review”, and then click “Save”.

Once you click “Save”, the page will reload and show a green “Save Successful” message. The application status will have changed back to “In Progress” and the borrower will be able to edit and submit their loan form again. Now is a good time to contact the borrower and inform them of any required edits.

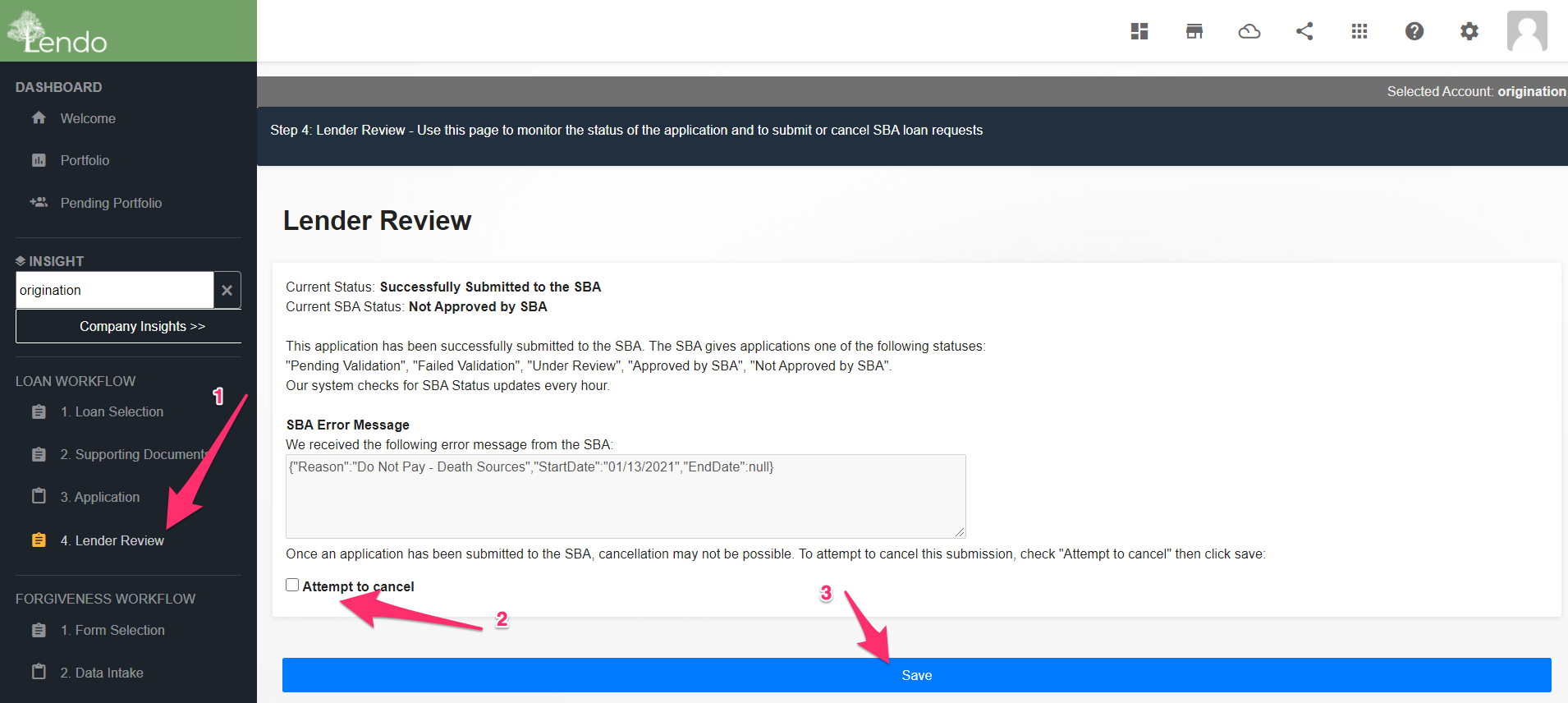

Cancelling Applications

After an application has been successfully sent to the SBA there is a period where it may still be cancelled before the SBA attempts to process it. Also if an application is declined it may need to be cancelled before it can be resubmitted.

To cancel an application click “Lender Review” in the sidebar. Click the “Attempt to cancel” checkbox and click the save button. The system will now attempt to cancel the application, this may take up to an hour to process but once it does a new status will appear when viewing the lender review.

Takeaways and Key Tasks for Lenders

Several tasks need to be done on a periodic basis or in response to certain events, these are:

(optional - if using the application request page (a.k.a. Prescreening System) ) Review of application requests should be performed each day so that qualified borrowers can be invited to complete an application. This task is typically delegated to a smaller subset of you loan managers

Add applicants that request a loan via phone, email and other contact methods, all loan managers added to the platform have the ability to add additional clients as applicants for the loan process, they may bypass the application request stage.

Review completed loan applications and approve/reject SBA submission - typically the loan officer assigned to a given client is responsible for reviewing a loan application to ensure information is provided correctly and to authorize submission to the SBA.

Disburse funds to SBA approved borrowers - Once the SBA has issued a Loan ID the task of disbursing funds to the applicant can be authorized (pending any other internal processes)