Guidelines for the new Borrower Application Forms for Schedule C filers

This page shows you how the new forms are handled in our portal and how borrowers and lenders can use the new Borrower Application Forms for Schedule C filers.

Looking to convert an existing application? Check out How to convert existing regular applications to the new Borrower Application forms for Schedule C Filers

Contents:

What the new Borrower Application Forms are for

The U.S. Small Business Administration (SBA) issued new Paycheck Protection Program (PPP) rules that allow self-employed individuals who file Form 1040, Schedule C, Profit or Loss From Business, to calculate their maximum loan amount using gross income instead of net profit.

The change opens the door for larger loans to self-employed individuals, many of whom don’t record much, if any, net profit on their Schedule C (Form 1040).

The new forms are the following:

SBA Form 2483-C (PPP First Draw Borrower Application Form for Schedule C Filers)

SBA Form 2483-SD-C (PPP Second Draw Borrower Application Form for Schedule C Filers)

The new forms should only be used by a sole proprietor, independent contractor, and self-employed individuals who has previously filed IRS Form 1040.

How to apply using the new forms

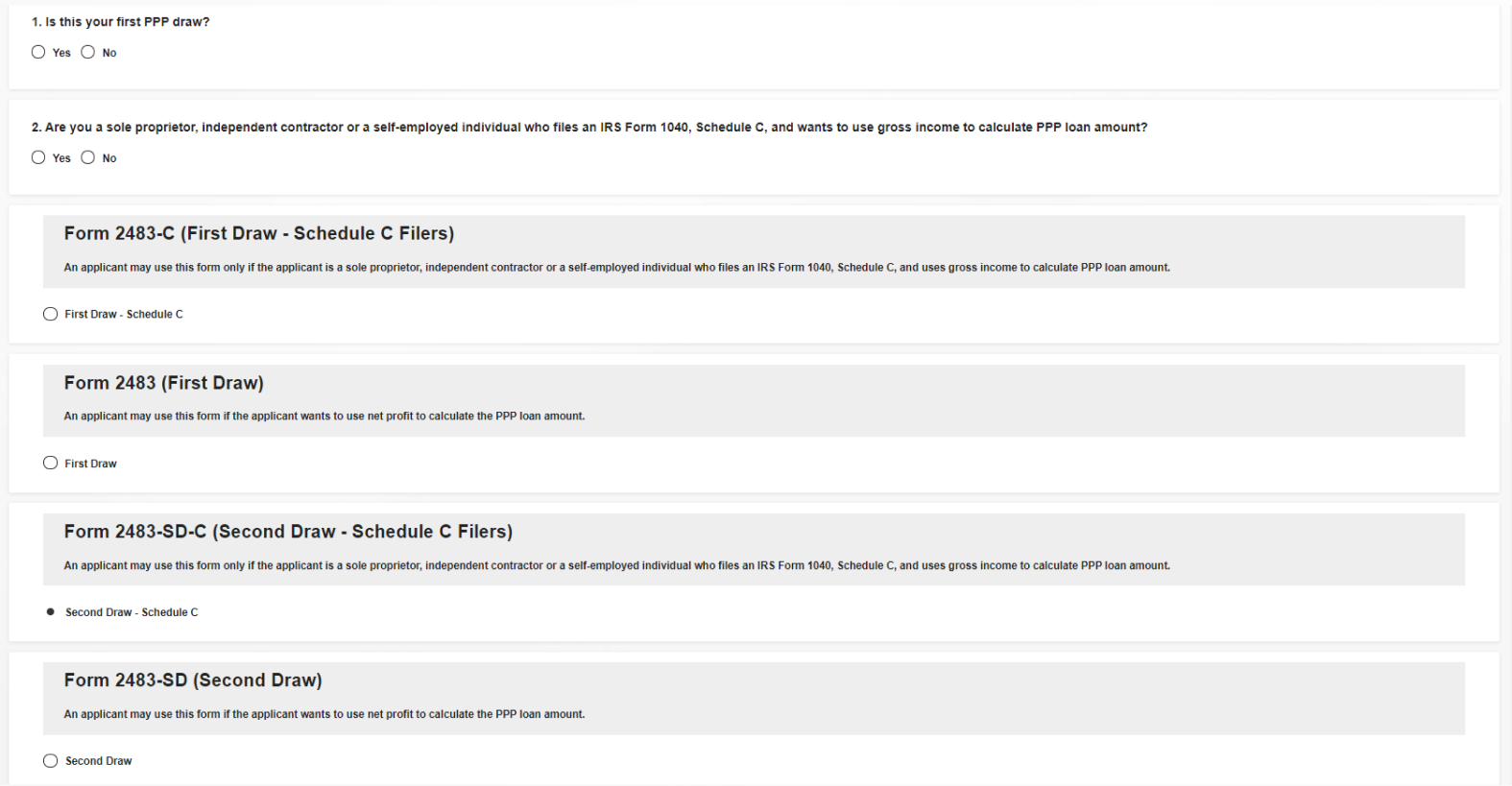

On the PPP Loan selection page of the borrower’s profile, you will be guided on which form to choose. There will be two (2) questions, and each question will show which forms are applicable or recommended for that selection. The screen will look like this:

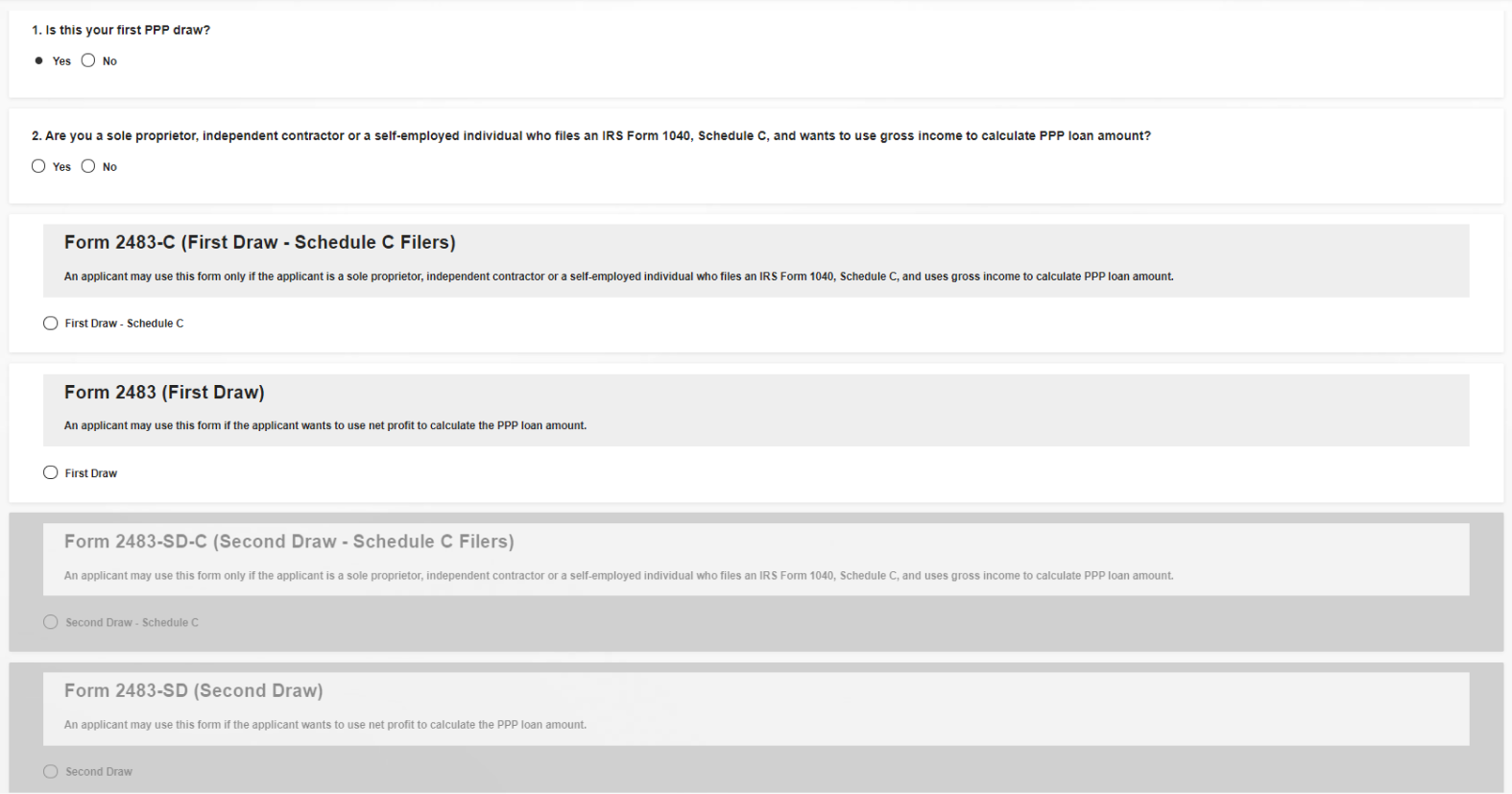

Step 1: For #1, If it is the borrower’s first draw, select “Yes”. If this is the borrower’s second draw, select “No”. The portal will gray out/disable forms that is not applicable for the draw stage. By selecting the first draw, the forms for the second draw will be disabled. For this walkthrough, let’s select the first draw.

Step 2: For #2, if the borrower is:

a sole proprietor, independent contractor, or a self-employed individual,

has filed an IRS Form 1040 Schedule C, and

wants to use gross income to calculate their PP loan amount,

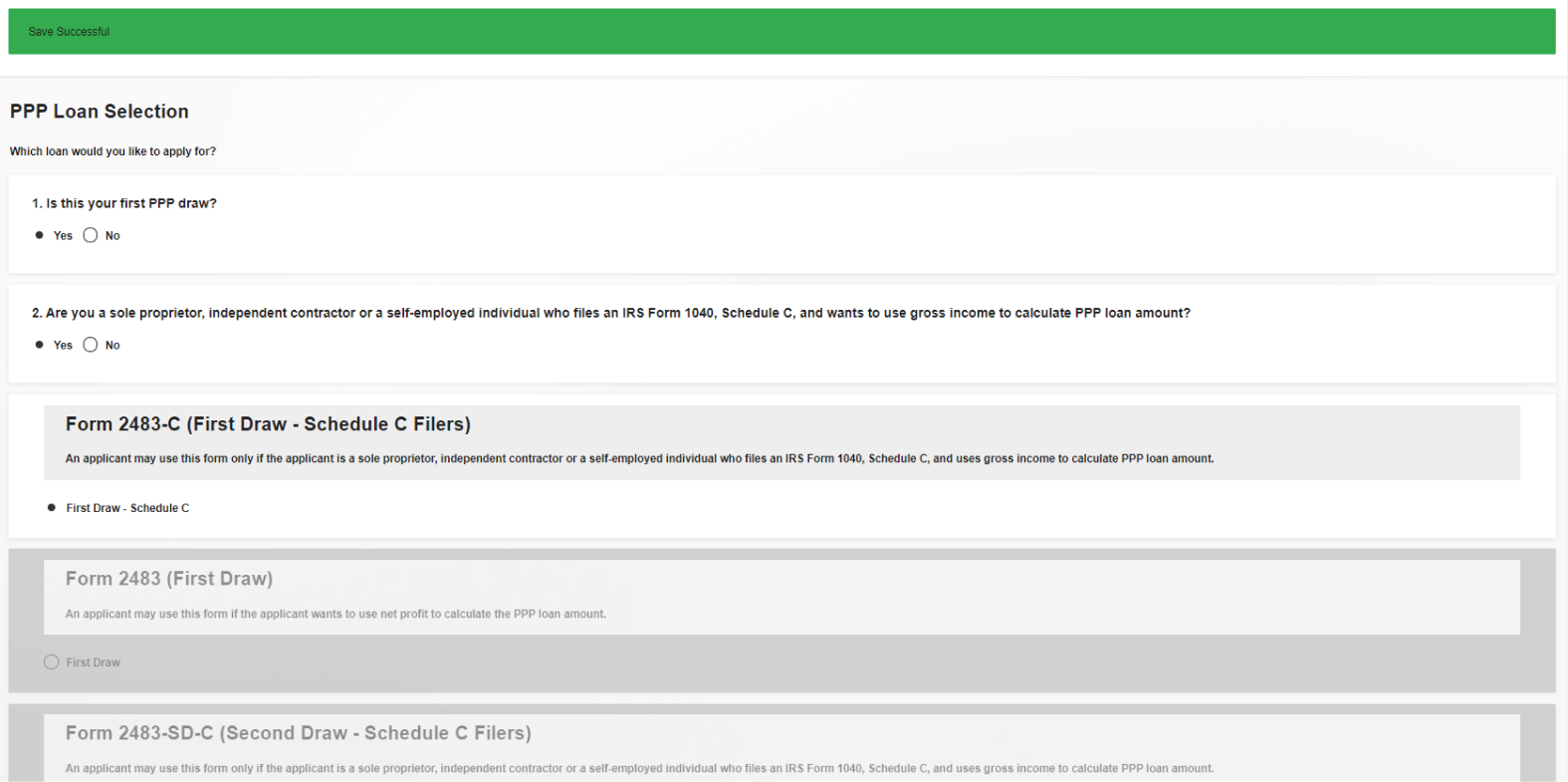

then select “Yes”. The portal will gray out/disable the regular form for that draw stage and will automatically select the recommended form. In the screenshot, we selected “Yes” for #2, so our portal will disable the regular form, and will automatically select the Schedule C form.

Step 3: Click “Save”. You should see a green banner on top that says saving the form is successful.

You should now be able to proceed and use the Schedule C variant of the loan application form for your first or second PPP Draw.

Frequently Asked Questions (FAQs)

Our FAQs are solely platform related. For Schedule C Form-related questions, visit the U.S. SBA Interim Final Rule (IFR) for Schedule C.

How can the borrower apply?

The borrower can follow the instructions above.

Can the borrower start again using the Schedule C variant from a regular form?

The borrower can go to the “Loan Selection” page and select the Schedule C variant if their application for the draw has not yet been approved by the SBA (please see next FAQ).

Can the borrower convert an application that is using the regular forms to the Schedule C variant?

Yes! Boss Insights has made it easy for lenders and borrowers to convert applications to the Schedule C variant in minutes. Please visit:How to convert existing regular applications to the new Borrower Application forms for Schedule C Filers

When can a borrower reapply?

For Lenders:

If you submitted an application using our platform and it has not yet been approved by SBA, you may try to withdraw/cancel the application from our portal.

If the application has been approved but the loan has not yet been disbursed, you may cancel the loan in E-Tran Servicing and the applicant may apply for a new loan using the new application form. (The loan cannot be cancelled in our platform once it has been approved by SBA.).

If you have disbursed the loan but you have not yet filed the related Form 1502, you may cancel the loan in E-Tran Servicing and the applicant may repay and apply for a new loan using the new application form.

If you have disbursed the loan and filed the related Form 1502, the loan cannot be canceled. Revisions to loan amounts must be made by using the new loan application forms (no loan increases).

If the loan has already been approved by SBA, you will not be able to cancel using our portal. Approved loans must be canceled in E-Tran Servicing; the cancellation may take up to 2 days to update actions in E-Tran Servicing (can’t enter new loan application until the Platform recognizes the prior loan’s cancellation)

For more information for lenders from the U.S. SBA, please look at the revisions document.