How to convert existing regular applications to the new Borrower Application forms for Schedule C Filers

In this page, we show you how to convert existing regular applications (Form 2483, Form 2483-SD) to the new Borrower Application Forms for Schedule C Filers (Form 2483-C for First Draw, Form 2483-SD-C for Second Draw).

If the borrower has already submitted the application and is awaiting lender review, the lender will need to unlock the application first before the application can be converted.

If the loan is already approved by the SBA it will need to be cancelled in ETRAN first. The SBA then has a one day delay before its internal systems are synchronized and then within the Boss Insights borrower portal you need to select the LENDER RESET option from the lender review step to unlock the application for resubmission

Looking for instructions for new borrowers? Check out Guidelines for the new Borrower Application Forms for Schedule C filers

How to convert

The instructions below are similar for lenders and borrowers. Both the lender and the borrower can convert the application.

In this walkthrough, it is the borrower’s first draw. The borrower has already filled out Form 2483, but the borrower is a sole proprietor and would like to convert their application from the regular form to the Schedule C filers form (First Draw, Form 2483-C).

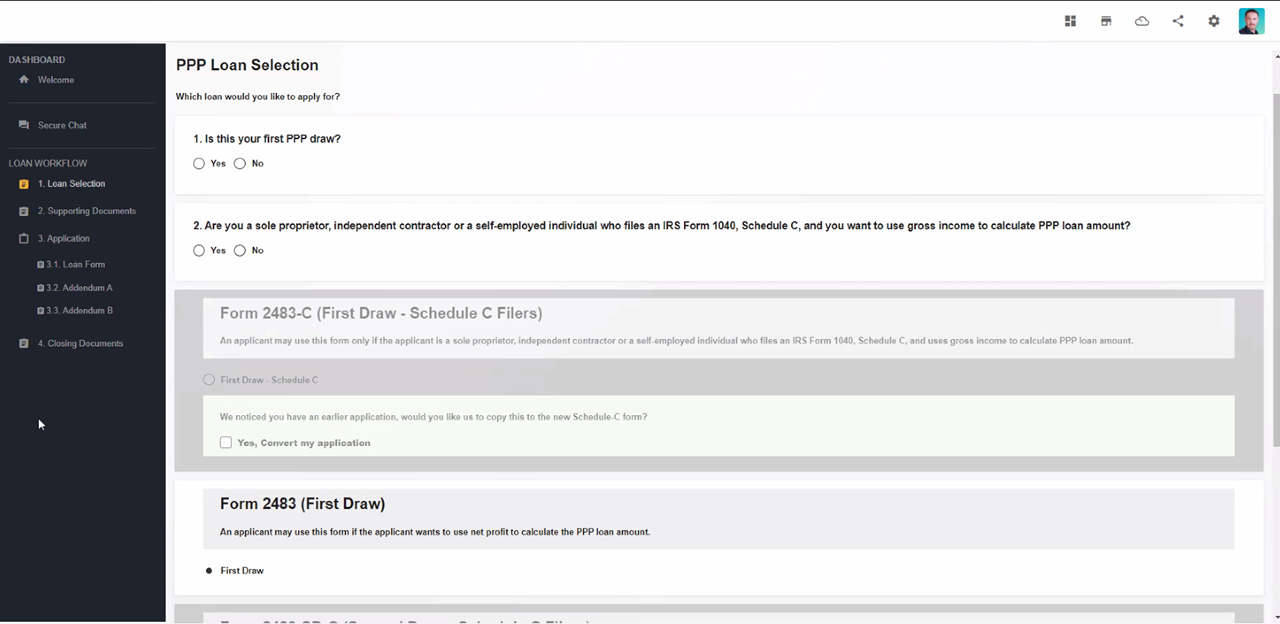

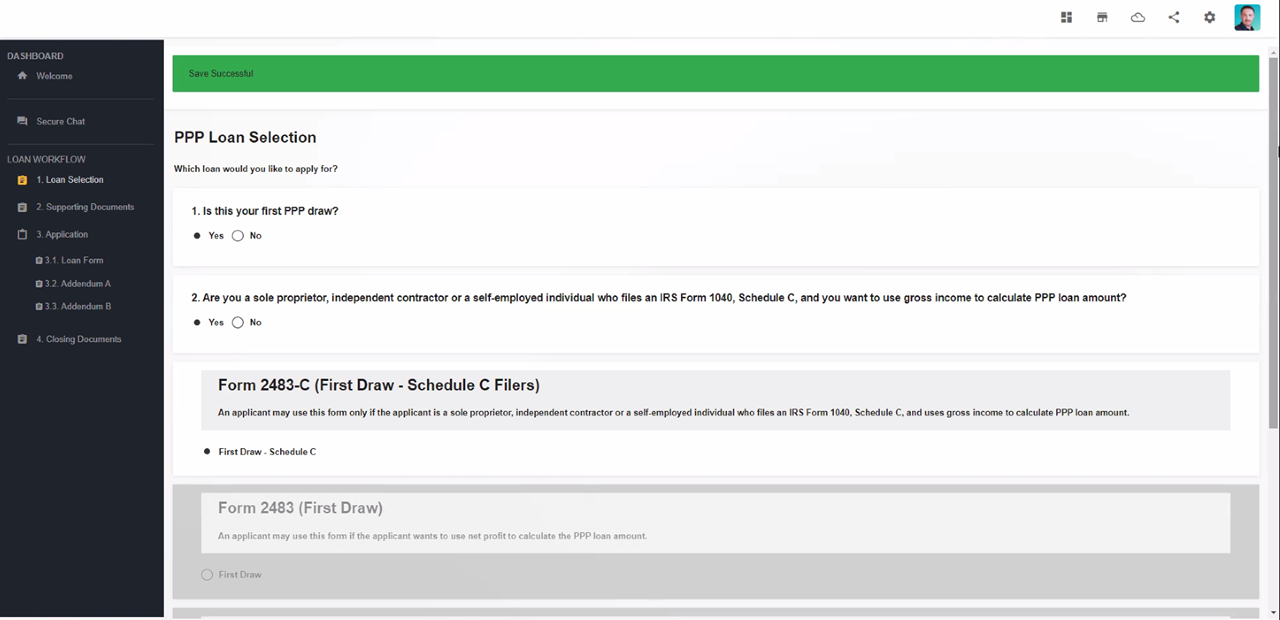

Step 1: Click on “Loan Selection” on the left navigation bar of the borrower’s portfolio page. You will see that the Form 2483 for First Draw or Second Draw has already been pre-selected based on the existing form that the borrower has started to fill out. Questions #1 and #2 will be blank.

In the screenshot below, it is the borrower’s first draw and the borrower has already filled out Form 2483.

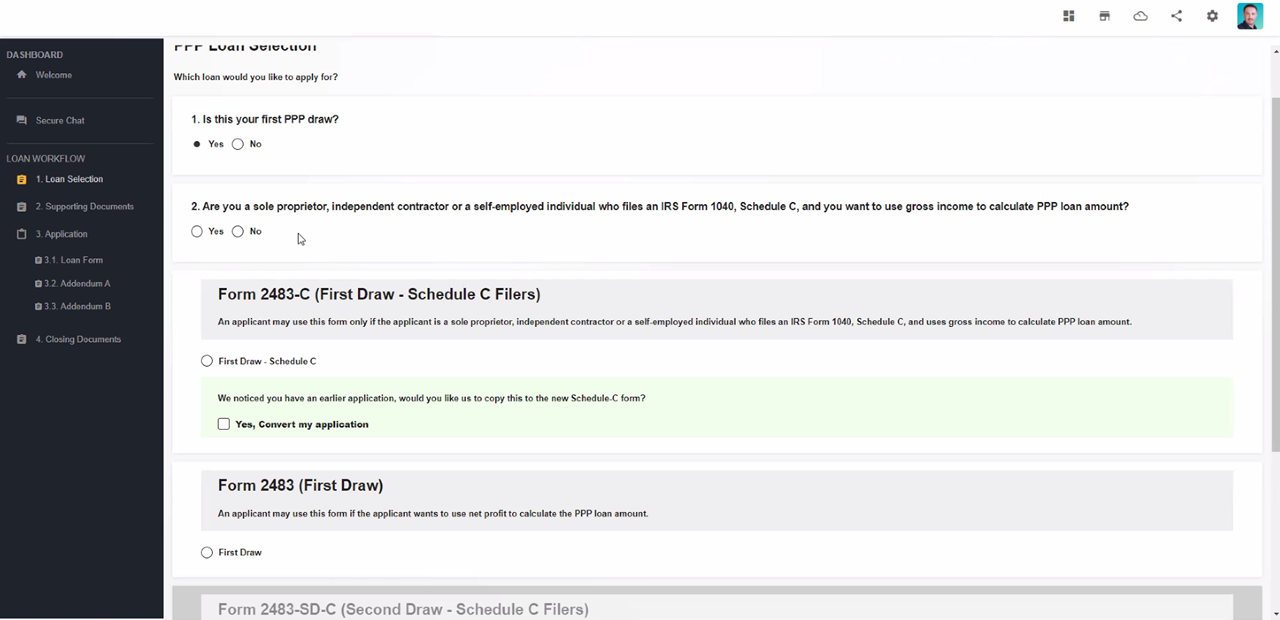

Step 2: Answer question #1 and make sure that it is similar to the existing form’s draw stage. (If it is the first draw, click “Yes”, if it is the second draw, click “No”.) The forms that are not applicable for the draw stage will be disabled.

In this walkthrough, it’s the borrower’s first draw, so we will click “Yes”. The forms for the second draw will be disabled and will not be selectable.

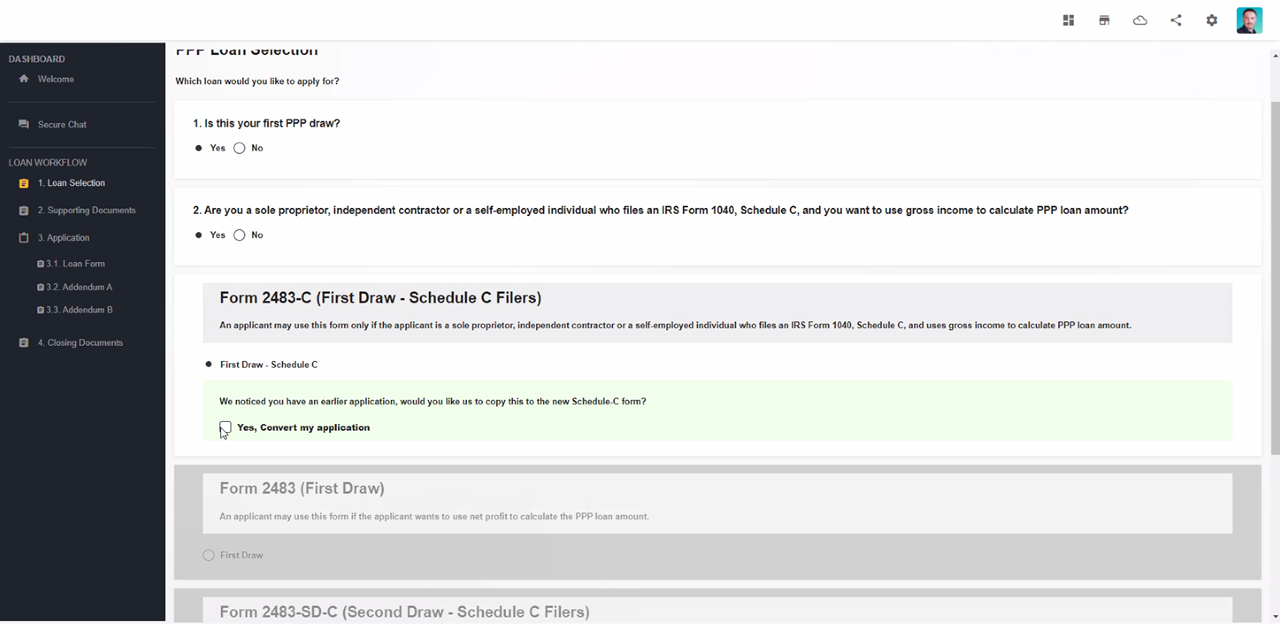

Step 3: For question #2, the borrower is a sole proprietor, so we will click “Yes”. In the screenshot below, you will see that the regular form (Form 2843) has been disabled and Form 2843-C has been pre-selected.

Step 4: To tell the portal to transfer applicable data from the regular form to the Schedule C filers form for the same stage, check the checkbox “Yes, Convert my application”.

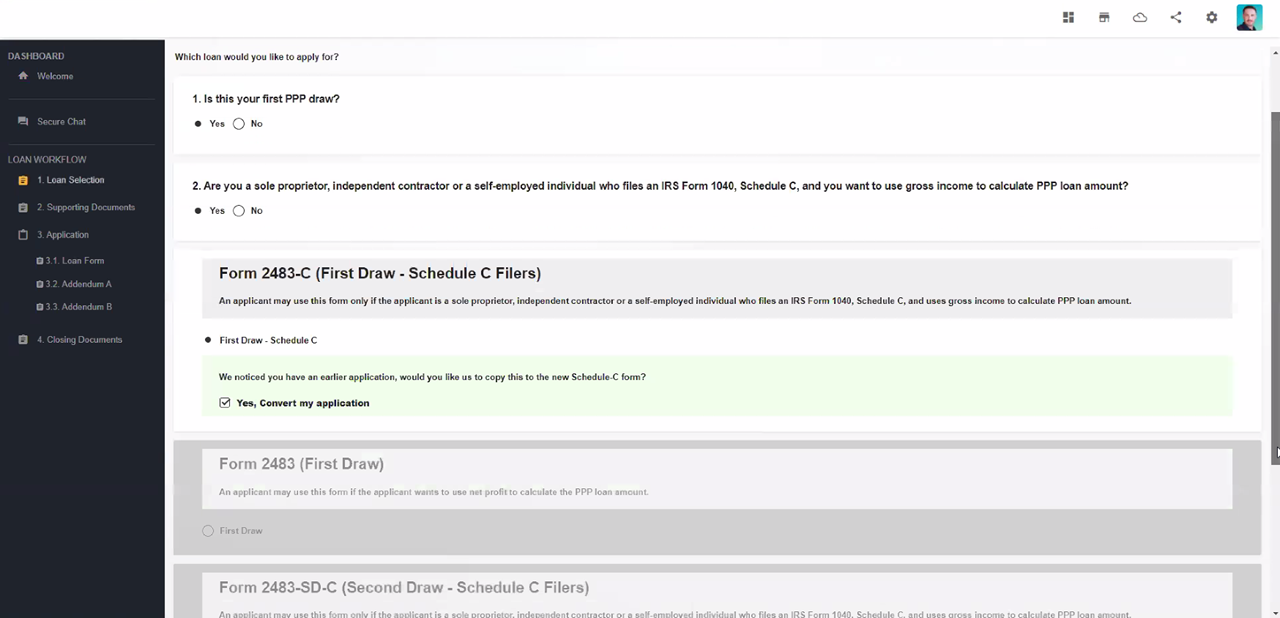

Step 5: Make sure that the “Yes, Convert my application” checkbox is checked, then click “Save”. A green notification bar will notify you that saving is successful.

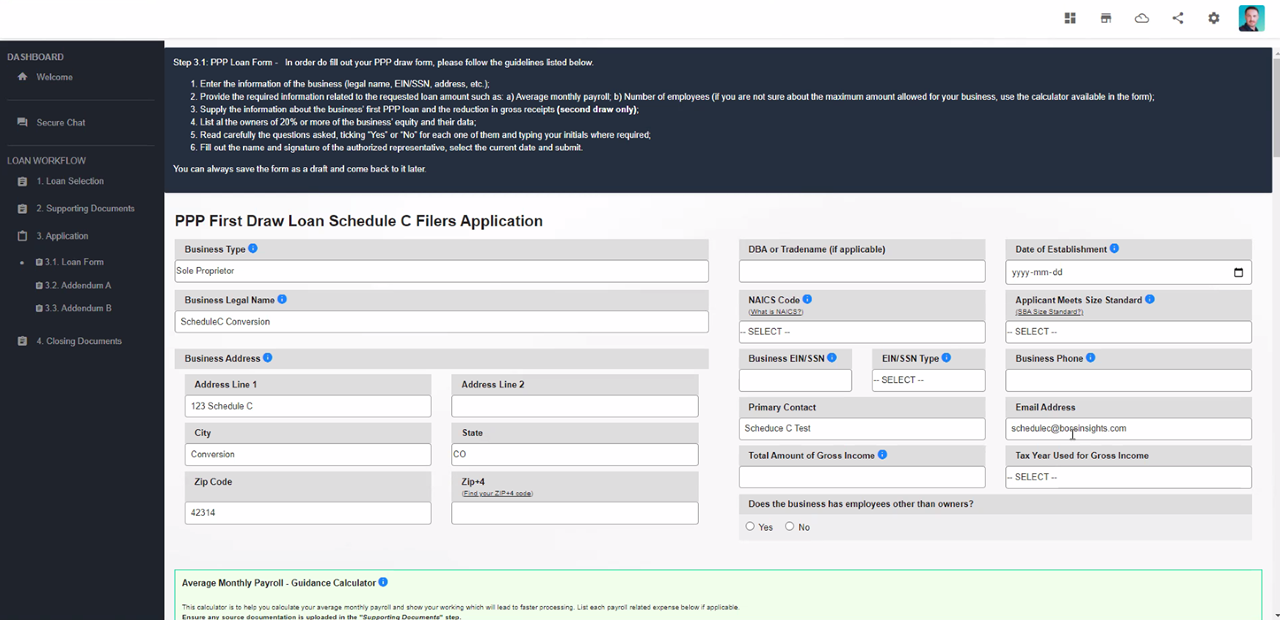

Step 6: After you’ve confirmed that saving the selection is successful, click on the “3.1. Loan Form” on the left navigation bar. You will see that any data that has been filled out in the regular form that is also applicable to the Schedule C filers form will be transferred.

You have now converted the regular form to the new Borrower Application Form for Schedule C for the same draw stage.

The new Schedule C filers form includes new fields and data that was not found on the regular form. Please make sure to recalculate and check all fields to make sure that you are applying correctly. For any questions, you may refer to the U.S. SBA Paycheck Protection Program FAQs for Lenders and Borrowers.